By Don Terry, Ben Emos & Mary Jones | Sunday, October 12, 2025 | 8 min read

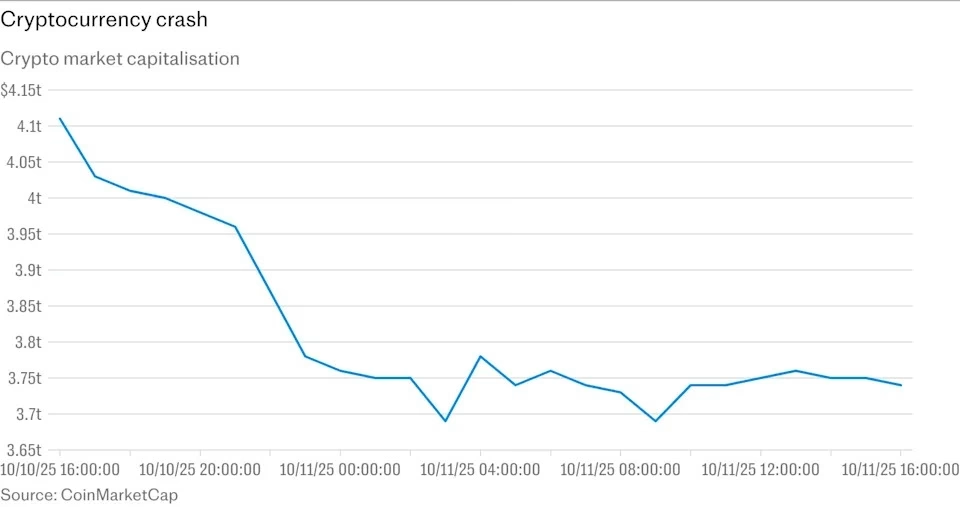

Global markets are heading into what could be one of their stormiest weeks of the year after Donald Trump’s surprise tariff threat on China sent cryptocurrency prices into a freefall and investors into panic. On Friday night, the former U.S. president vowed to impose 100% tariffs on Chinese imports within weeks, setting off one of the sharpest market reactions since the 2022 crypto crash. Within a single day, more than $400 billion (£300 billion) in value vanished from the digital asset market, a staggering loss that has rattled both Wall Street and Main Street.

The impact was immediate and brutal. Bitcoin, the bellwether of the crypto world, plunged more than 10% within hours of Trump’s speech and then slid further through Saturday morning, finally stabilizing around £83,838 — down nearly 16% over 24 hours. Leveraged traders, who use borrowed funds to amplify their bets, were among the hardest hit. A record-breaking $19 billion in leveraged positions was wiped out overnight, dwarfing the previous worst day during the May 2021 crash, when losses reached $8.5 billion.

Because cryptocurrency trades nonstop, without the circuit breakers or closing bells of traditional finance, Trump’s late-night remarks detonated like a bomb in a market that had no way to pause or catch its breath. One investor described the price plunge on X, formerly Twitter, as “watching a train wreck happen in real time.”

Behind the numbers, there were human tragedies too. Ukrainian police confirmed the death of Kostyantyn Ganich, a 32-year-old entrepreneur and prominent crypto blogger known online as Kostya Kudo, who was found in his car with a gunshot wound. According to local reports, he had confided to relatives that he was struggling with financial difficulties in the wake of the market collapse. His Telegram channel, which had tens of thousands of followers, shared a simple, devastating message: “Kostya has tragically passed away.”

“It’s brutal,” said Marcus Sotiriou, a crypto analyst at Impact Fundry. “Some of these traders had multi-million-dollar portfolios. Now they’re gone overnight. The emotional and financial toll is enormous.”

Major crypto exchanges buckled under the weight of panic trading. Binance, the world’s largest exchange, was forced to issue an apology for “intermittent delays and display issues” amid what it called “unprecedented market activity.” Many traders said they couldn’t close their positions in time, compounding their losses.

What makes this episode even more explosive is Trump’s own entanglement with the crypto industry. Though not an active trader himself, he has quietly built a network of deals, licenses, and partnerships tied to digital assets both in the U.S. and abroad. His NFT collection, launched in late 2022 and expanded twice since, has earned millions in revenue and remains popular among retail buyers in politically conservative circles. Trump’s digital asset wallet was last publicly valued at over $5 million earlier this year, mostly from his branded tokens and NFT royalties.

But beyond NFTs, Trump has also cultivated relationships with foreign crypto-linked investors, particularly in the Middle East. People close to his business empire have pointed to Dubai-based funds and several offshore entities in the Caribbean that have engaged in negotiations over Trump-branded crypto projects. One of these projects reportedly involves tokenizing luxury real estate linked to the Trump Organization’s licensing deals.

These ventures could now be facing new headwinds. The crash has already erased a huge portion of speculative capital that might otherwise have flowed into politically linked projects. “This kind of market shock tends to hit fringe and personality-driven tokens the hardest,” said Karen Ho, a blockchain policy expert in Washington. “Assets connected to Trump’s brand rely heavily on retail sentiment, and retail just got crushed.”

Analysts say the tariff move may also complicate Trump’s overseas crypto ambitions. Dubai, which has become a global hub for digital assets, has deep trade and financial ties with both the U.S. and China. If trade tensions escalate, the ripple effects could undermine regulatory confidence and tighten liquidity in offshore crypto markets. “Trump’s name carries political weight, but it doesn’t shield his deals from market physics,” Ho added.

Meanwhile, whispers of insider activity have only deepened the controversy. Several anonymous wallets reportedly made nearly $200 million betting against Bitcoin less than an hour before Trump’s announcement. Joshua de Vos of CoinDesk noted that “the timing and scale of these positions raise questions,” though he stressed there is no hard evidence of insider trading. Still, the speculation has intensified because of Trump’s known proximity to crypto circles through political donors, influencers, and personal business ventures.

All of this is happening at a time when broader markets were already showing signs of strain. Tech stocks have been floating on what many analysts see as a bubble fueled by AI hype. The Bank of England recently warned that inflated valuations in the tech sector pose a “material” risk to the UK economy. In the U.S., JPMorgan CEO Jamie Dimon has voiced growing concerns over a potential “sharp correction,” saying valuations “appear stretched” and could snap under pressure.

Adding more fragility is the $3 trillion private credit market — lightly regulated lending that operates outside traditional banking. Two recent high-profile bankruptcies, First Brands and Tricolour, have exposed vulnerabilities in this shadow system. Their sudden collapses have raised alarms about whether risk is being properly accounted for in the private credit sector. Shares in Apollo, Blackstone, KKR, and Ares — major players in that space — fell an average of 4.5% on Friday and are down nearly 18% over the past month.

Trump’s announcement poured fuel on this already smoldering fire. The planned tariffs would quadruple levies on Chinese imports from 30% to 130%, the largest jump of its kind in modern U.S. trade history. Beijing had just imposed strict export controls on rare earth minerals, an aggressive move that affects supply chains for cars, electronics, solar panels, and defense systems. Trump called China “very hostile” and accused it of trying to “make life difficult for virtually every country in the world.”

Markets do not like unpredictability, and Trump’s rhetoric — combined with his private business interests — adds an extra layer of complexity. Some international regulators have already expressed concerns that a sitting or prospective president involved in personal crypto ventures creates potential conflicts of interest. “When the person who moves markets also has financial skin in the game, it raises difficult questions,” said Jean-Paul Toure, a financial ethics researcher based in Geneva. “Whether or not there’s wrongdoing, the perception alone can amplify volatility.”

Trump’s team has repeatedly denied any wrongdoing, emphasizing that his NFT and token ventures are legal and fully disclosed. But this weekend’s chaos highlights how closely political power, personal wealth, and market sentiment can intertwine in the modern financial system.

For crypto investors, the immediate concern is survival. Many have been forced to liquidate, some at devastating losses. For global markets, the bigger question is whether this was a short, sharp shock — or the opening tremor of a wider crisis. Nicolas Bickel of Edmond de Rothschild said Friday’s tariff threat was “clearly unexpected” and “a direct blow to already fragile investor confidence.” Chris Beauchamp of IG warned of “a volatile Monday open,” saying traders will be “jittery for days.”

As the dust begins to settle, the consequences for Trump’s own crypto ventures remain uncertain. If confidence in speculative digital assets continues to erode, his branded projects could lose momentum and investor appetite abroad may dry up. At the same time, the controversy could deepen regulatory scrutiny in the U.S., where lawmakers have already floated new disclosure requirements for public officials engaged in crypto.

For millions of retail investors around the world, however, those political calculations may feel distant. What they see right now is red on their screens, empty portfolios, and a future suddenly much more uncertain.

Comey’s Charges Had Nothing to Do With Russia Interference — This Was Trump’s Payback

Epstein Files Put Musk Back in Spotlight—Could Tesla’s $29 Billion Shareholder Payout Be at Risk?

Mexico Is Not the Origin of the Drug Trade—Europe and Big Pharma Were There First

Trump’s Russia ‘Paper Tiger’ Remark Steals the Spotlight as 2025’s Best Punchline

Nexstar, Sinclair Refuse to Broadcast ‘Jimmy Kimmel Live!’ Following ABC Return